The dollar moves to rebound

Very little has happened in the dollar market for many weeks. It stuck in a side move, which was also preceded by a significant weakening of the USD from previous months, along with a rebound since March and an increase

Russell 2000 in retreat

While the Nasdaq or the wide S&P500 not so long ago broke further bullish records, a slightly different picture appears from the behavior of smaller companies, represented by Russell 2000. In this case, after the covid panic, it was not

The biggest drop in the current upward move on the Nasdaq

The Nasdaq rebounded almost 90% from the trough in March. This sector is the leader of the entire recovery. However, the mood among investors is extremely optimistic, and technology companies are mostly interested in the youngest investors. On the one

Falling dynamics of the dollar weakening

Tuesday morning, and thus the new month, begins with the continued weakening of the dollar. In the case of EUR / USD, this move pushes the market to the round 1.20 level. However, if we look at the balance of

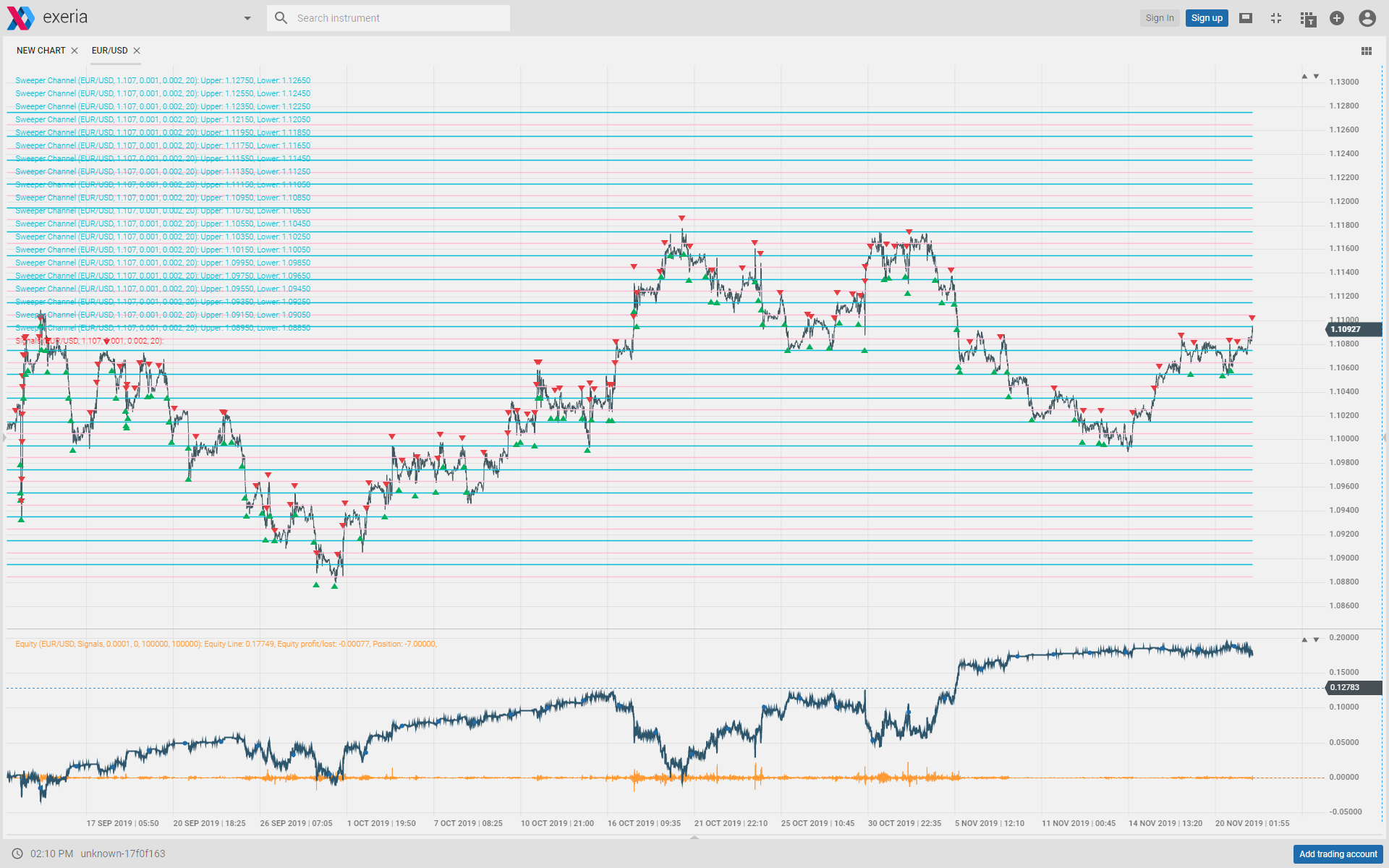

Out of breath after 8 consecutive weeks of EUR/USD increase

The past days have brought the Eurodollar retraction, which leaves a noticeable upper shadow on the weekly chart. It is worth noting that the 8-week rally with EUR / USD has been gaining steadily behind us. A retreat from the

DAX very close to the sell signal

Level 13000 points on DAX has been causing problems for the bulls for a long time. This can be seen on the first weekly chart. This is where a lot of market reaction has occurred, both from below and above.

LATEST ANALYSIS

The dollar moves to rebound

Very little has happened in the dollar market for many weeks. It stuck in a side move, which was also preceded by a significant weakening of the USD from previous months, along with a rebound since March and an increase

Russell 2000 in retreat

While the Nasdaq or the wide S&P500 not so long ago broke further bullish records, a slightly different picture appears from the behavior of smaller companies, represented by Russell 2000. In this case, after the covid panic, it was not

The biggest drop in the current upward move on the Nasdaq

The Nasdaq rebounded almost 90% from the trough in March. This sector is the leader of the entire recovery. However, the mood among investors is extremely optimistic, and technology companies are mostly interested in the youngest investors. On the one

Falling dynamics of the dollar weakening

Tuesday morning, and thus the new month, begins with the continued weakening of the dollar. In the case of EUR / USD, this move pushes the market to the round 1.20 level. However, if we look at the balance of

Out of breath after 8 consecutive weeks of EUR/USD increase

The past days have brought the Eurodollar retraction, which leaves a noticeable upper shadow on the weekly chart. It is worth noting that the 8-week rally with EUR / USD has been gaining steadily behind us. A retreat from the

DAX very close to the sell signal

Level 13000 points on DAX has been causing problems for the bulls for a long time. This can be seen on the first weekly chart. This is where a lot of market reaction has occurred, both from below and above.

LATEST EDUCATION

Can investing be learned?

The secret of Turtle Traders' success Beginner investors often ask the more advanced: whether to achieve success you have to be born with qualities that will make you succeed, or investing can be learned by treating it like any skill.

How algorithms change investing

Processors, memory, resources, algorithms, codes and many other similar topics are becoming more and more popular in more and more areas of our lives. Automation, computer science and robotics sometimes revolutionary and sometimes imperceptibly appear in areas where they were