In 2020, gold gained over 25%. In times of crisis and uncertainty, many investors consider this metal a safe haven. Gold can be purchased in the form of bars and jewelery, but it is associated with high operating costs and storage costs. It is much easier to buy a financial instrument the price of which directly depends on the price of gold and which, like shares or bonds, will be deposited in your own investment account. If we do not know whether it is a good time to buy gold and when to sell gold, we will be able to use an automatic Robot, which, according to the prepared plan, will watch when to buy gold and when to sell it. Are you interested in investing in gold? Find out how to invest in it.

Gold is rare in nature. In practice, gold is mixed with other metals (e.g. silver or copper) to give a minting mark of 1000 grams of gold (e.g. 900 grams).

In gold trading, a troy ounce is used equal to 31.10 grams. It is also the main price index for quoting gold in the market. In futures transactions, e.g. on the New York COMEX, 100 ounces of gold are traded per contract, while on the Tokyo Commodity Exchange, the contractual unit of trading for both the options and futures markets for gold is 1 kilogram of gold (i.e. approximately 32.15 ounces).

A carat is used in the jewelry industry. 24 carat gold = 1000 grams of pure gold (24/24), 22 carat (22/24) = approx. 91.7% gold and approx. 8.3% other metals, 18 carat (18/24) = 75% gold and 25% of other metals.

Geographically, the world’s largest gold producers are: China, South Africa, Australia, the United States, Russia, Peru and Indonesia. The largest consumer of gold and gold jewelery is India, which accounts for approximately 20% of global demand. China (along with Hong Kong) and the United States are in second place, with shares at the level of several percent.

In terms of sectors, the jewelery industry is the primary recipient of gold and its demand exceeds 60%. Gold is also used in the automotive industry, electronics (transistors, semiconductors, optical fibers), and power engineering (submarine cables, telecommunications links). The broadly understood investment demand accounts for approx. 30% of the total demand for the ore. These are gold purchases for bars, coins, medals and purchases related to the issue and trading in financial instruments of the ETF type.

The recent changes in gold prices result from the events of 1971. Then, as a result of economic problems, the President of the United States, Richard Nixon, decided that US dollars would not be convertible into gold. There has been an actual liberalization of gold prices. In the following years, the average annual price of an ounce of gold increased from $ 41 to $ 307, i.e. seven and a half times. The peak of growth was in 1980, when the average price doubled, rising to around $ 615 / oz.

In the nineties of the previous century, interest in the ore as an object of capital investments was negligible and perceived mainly in anachronistic terms. The result of this approach to gold was the decision of a large group of central banks from Western Europe, which for ten years since 1999 have been implementing a program to reduce their gold reserves.

The first decade of the new century and the financial crisis that started in the fall of 2008 resulted in a definite “return to gold”, not only in a dematerialized form.

The global gold market, although still associated with specific trade centers, is in practice shifting to electronic trading platforms. Gold is traded, for example, on the New York COMEX operating within the Chicago Mercantile Exchange Group (to which NYMEX also belongs) and on CME Globex. The gold market has become similar to the FOREX currency market and is offered in the form of CFDs by most brokerage houses.

A relatively new dimension of the development of financial markets is the dynamically developing segment of the market of structured products and ETFs, in particular Gold ETFs. The largest entities of this type in the world include, among others SPDR Gold Trust (GLD), IShares COMEX Gold Trust (IAU), ZKB Gold (ZGLD), and ETFS Physical Gold (PHAU).

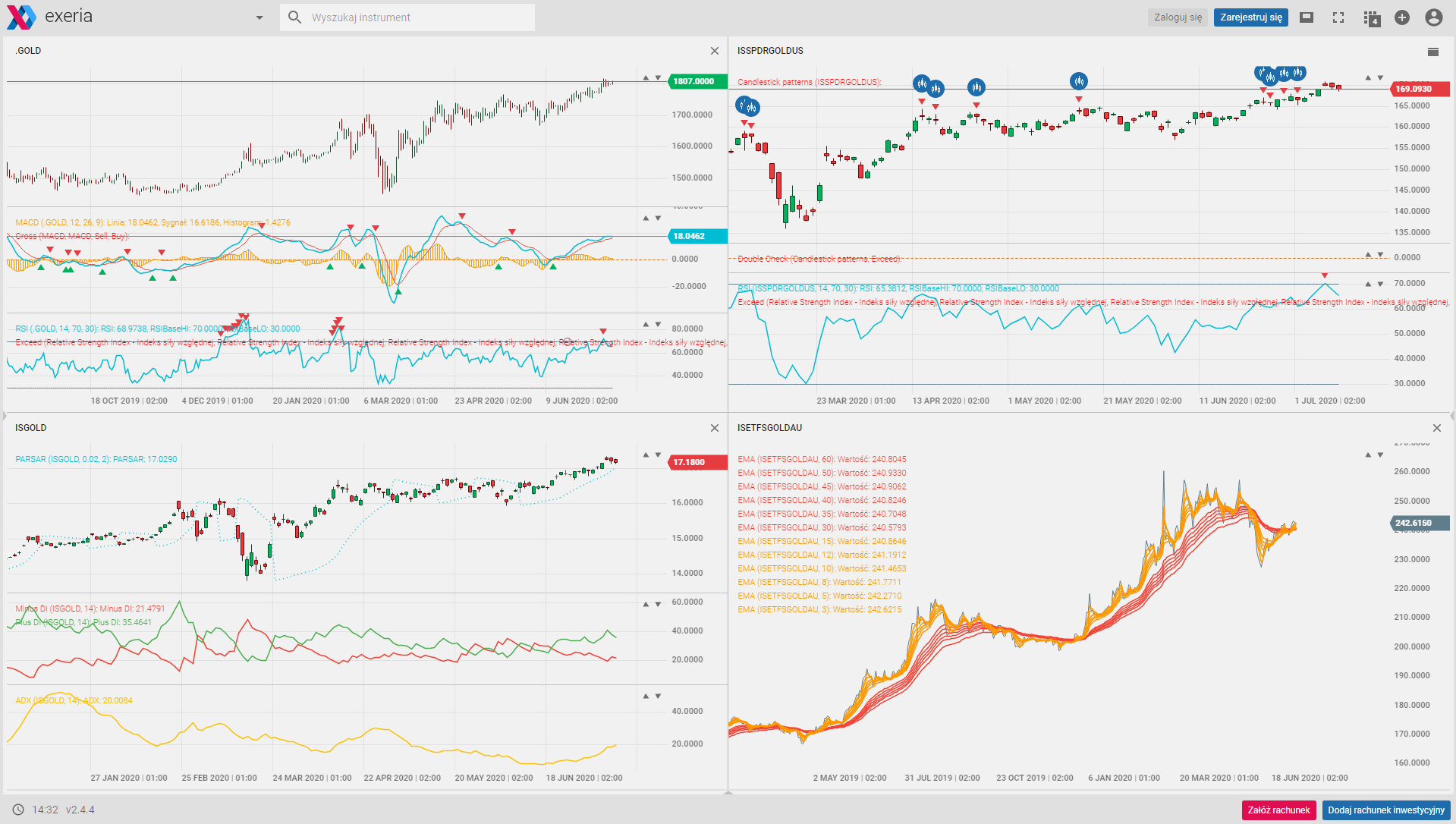

On Exeria.com, you can observe many instruments with prices depending on gold. These are CFDs on gold, mining stocks and ETFs. On the Exeria platform, you can buy and sell these instruments yourself, or use a ready-made Robot that will keep track of prices for you and conclude transactions at the right times.

Chart. Exeria.com website with charts of various instruments

Practical tips.

How to check and start investing in gold? Below you will find some practical information and tips.

1. In the first step, register on Exeria.com (click here) to have access to tools, information exchanged between website users and to the quotations described in the article. Registration and use of the website is free.

2. Start your gold investing adventure with a free demo account (click here). The demo account simulates a real account with virtual money, thanks to which you can test trading on gold without the risk and, additionally, the operation of ready-made or your own individual algorithms intended for the gold market.

3. If you want to deepen your knowledge on the use of algorithms on the gold market, call Exeria experts (tel. 510 010 363), write an email (exeria@exeria.com) and arrange a half-hour online meeting.

Half an hour spent with Exeria and a free demo account are enough to learn how to invest in an interesting way. Exeria, for its technology, won the first prize in the category “finding alpha” at the elite Benzinga Fintech Awards in New York. In Exeria, investors create a social network by exchanging ideas and information, creating and testing automated strategies, and trading using algorithms. By joining Exeria, you will take advantage of ready-made solutions and help develop the investor community by adding your own ideas.