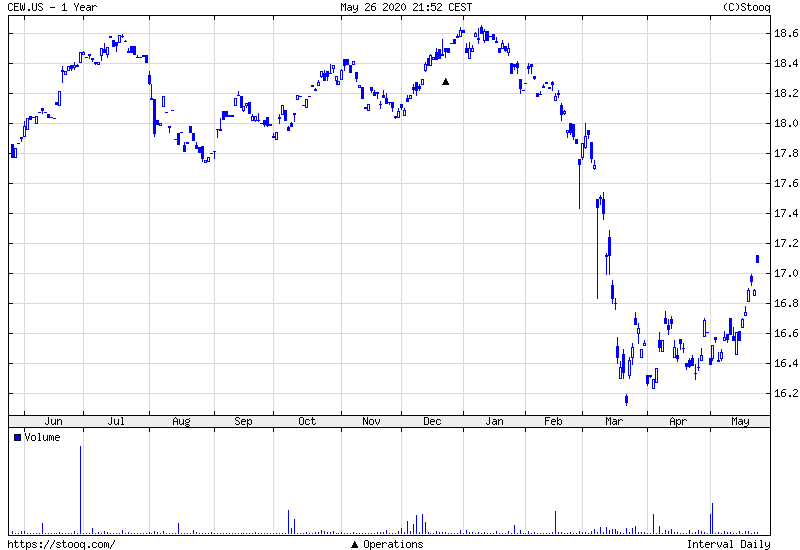

Past days definitely belong to the zloty. This is not an exception, however, as the improvement in moods has also spread across the remaining emerging markets, strengthening their currencies. This is well illustrated by the WisdomTree Emerging Currency Strategy Fund chart, i.e. the ETF that gives exposure to emerging market currencies (ticker: CEW), which has also started to recover in recent days.

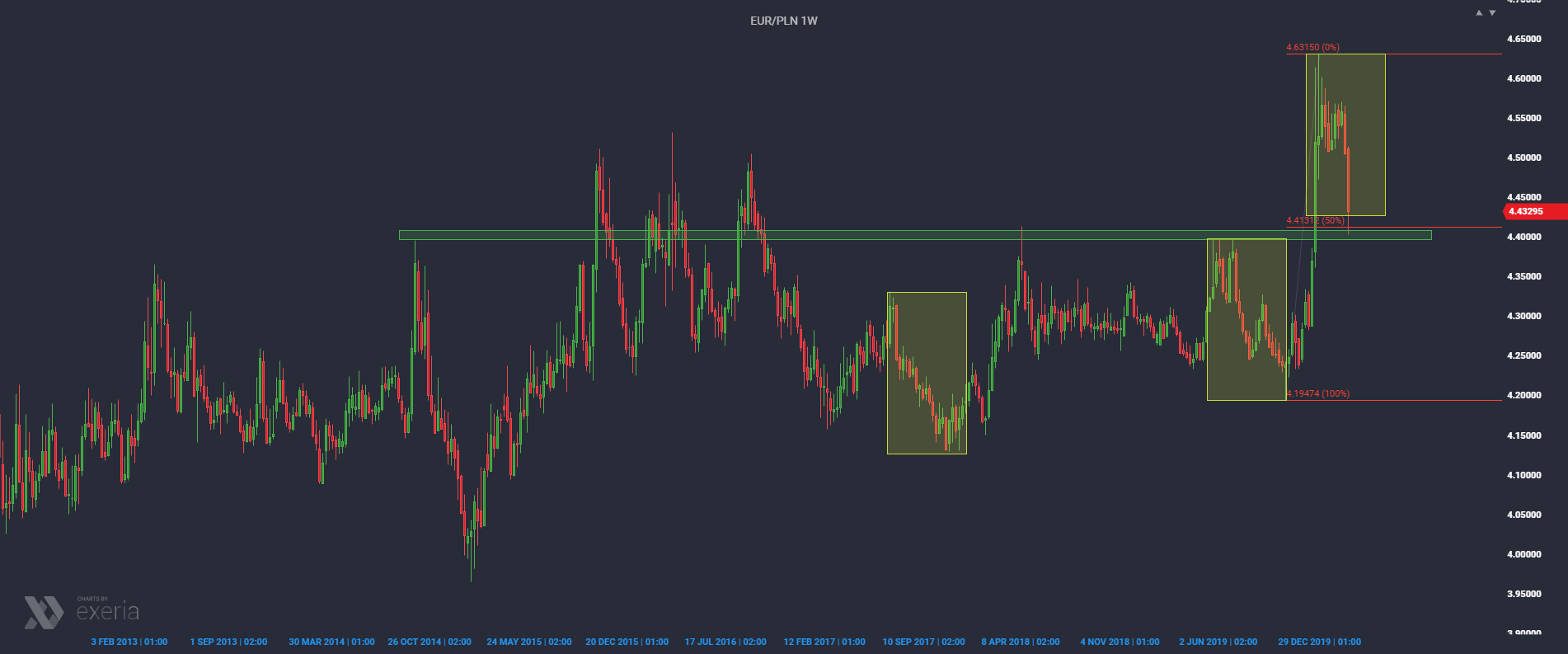

However, the strengthening of PLN in the short term is already considerable and you should be aware that the first levels that can stop this move are already at your fingertips.

On the EUR / PLN chart we will find support at 4.40, on which buyers have already reacted today. You will find here the area of earlier highs (i.e. resistance, which has now turned into support), 50% retracement of the last wave of strengthening of the euro, as well as overbalance, i.e. equality with earlier downward correction. So this is a place where the strengthening of the zloty can be stopped.

A more or less similar pattern can also be found on the dollar, where there is also a return to the nearest support in the area of 4.00. Buyers can basically use the same arguments here, i.e. the equality of corrections, earlier highs, or retracement of half of the recent upward movement.

So, if someone was planning to reduce their exposure in PLN, the current levels on the euro and the dollar are most suitable.