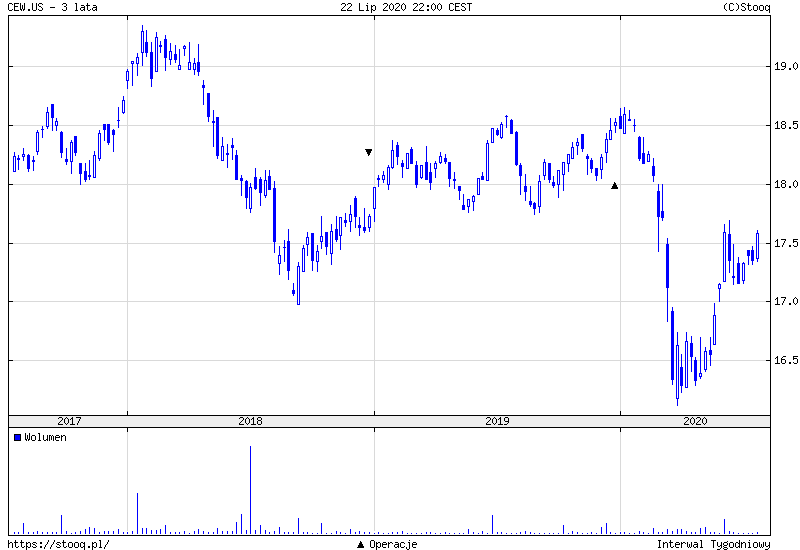

In recent days, the breakout of resistance at 1.1450 on EUR/USD brought a clear weakening of the dollar to many currencies, including emerging market currencies, which can be seen, for example, in the changes in the WisdomTree Emerging Currency Strategy Fund (CEW ticker), i.e. the ETF giving exposure to currencies EM countries. It begins again directed towards the highs of the last rebound after covidowej panic.

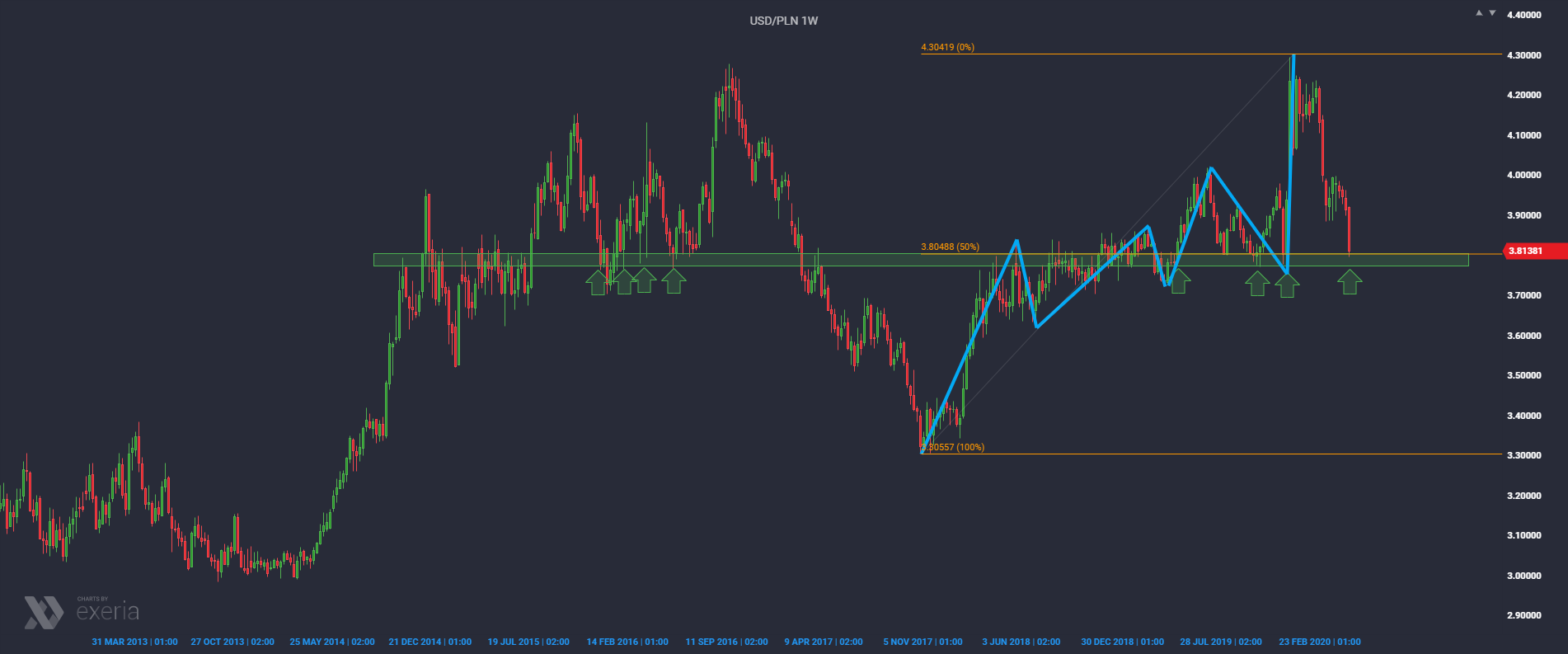

Also in the Polish market, the impact of the weakening dollar was visible. The main currencies lost against the zloty, especially the dollar, which moved towards another strong support, ie 3.78-3.80.

We can find here both horizontal elements that can support the market, but also 50% retracement of the entire, over 2.5-year upward trend. Importantly, it is still the current direction, and you can see it in impulses and corrections (marked with red lines). The basis of the last impulse is in the area from which USD/PLN started in response to covid panic.

To what level should the market at least bounce from there? The closest resistance in the weekly interval can be found in the area of round 4.00, which is the area where sellers have been activated many times recently. Should it be possible to get there, part of the market will likely see an opportunity to discount the right shoulder of the H&S pattern.