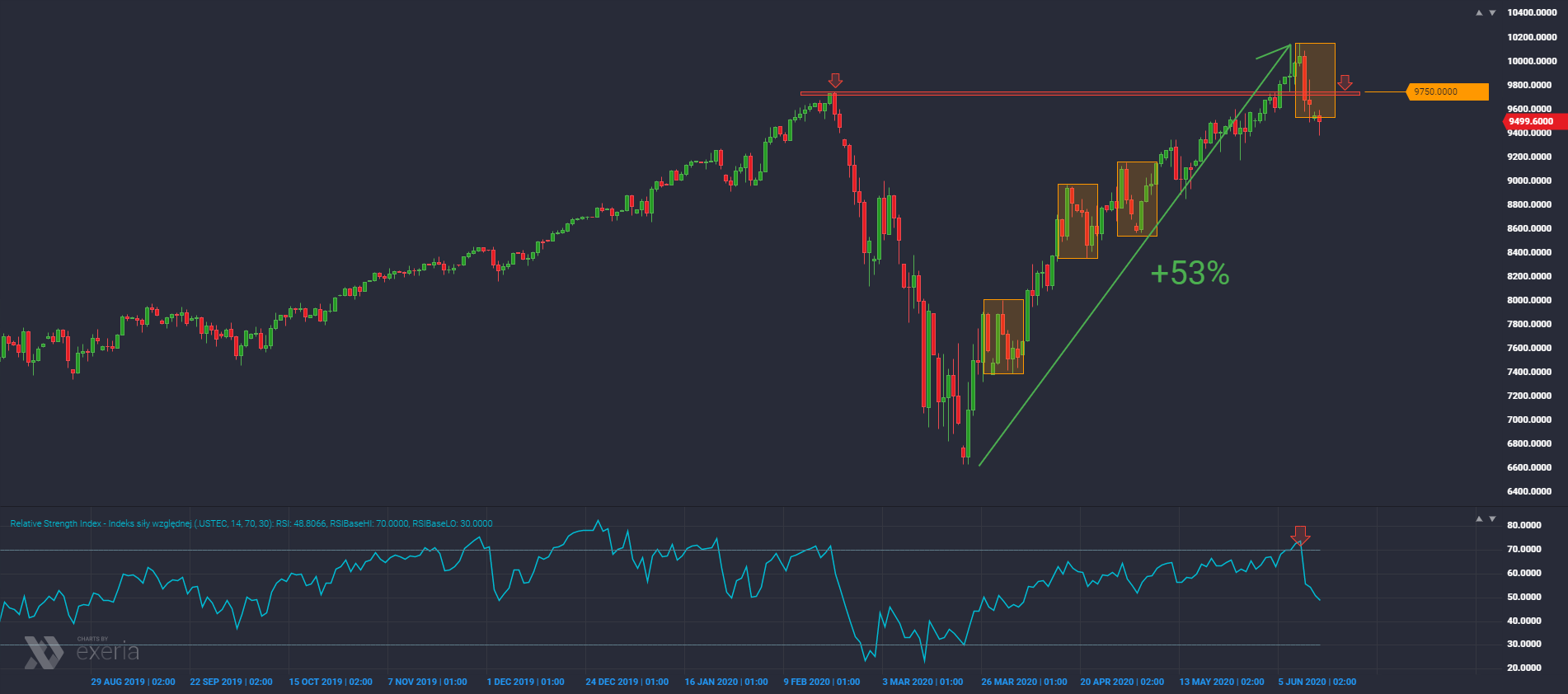

We are after a 2.5 month rally on the stock markets. The main beneficiary of the lockdown was the technology sector, especially on-line shopping, but also digital entertainment or e-learning platforms. This is clearly seen by the changes in major stock indices. Nasdaq was the first to return to pre-pandemic levels. The dynamics of the market recovery was impressive. From March low to last week’s highs the market increased by 53%.

As you can see on the chart above, the attempt to break the highs took place without much preparation, i.e. consolidation / correction, which can also be seen after overbought on the RSI. Engaging in buying at such times is usually associated with above average risk. The market actually remained at new levels only a few days, after which we saw a slightly more dynamic return in the second half of last week. Earlier breaking to new levels can therefore be called a trap. It will be very important now how the market behaves during an upward rebound and contact with the level of around 9750 points, i.e. the earlier high from February. If we see sellers here, it could be an opportunity to take short positions.

In addition to unsuccessful breakout into new highs, those using overbalance will also notice that the current correction from the peaks is the largest in the entire upward movement since March. Until now, we had three more or less equal corrections (yellow rectangles on the chart), amounting to approx. 620 points. So if the current decline has already exceeded this value, it means that buyers have a problem with maintaining the trend. Considering that the market decline occurred a moment after breaking high from February and the fact that we are after 53% increase in 10 weeks, it is a very risky mix for bulls.