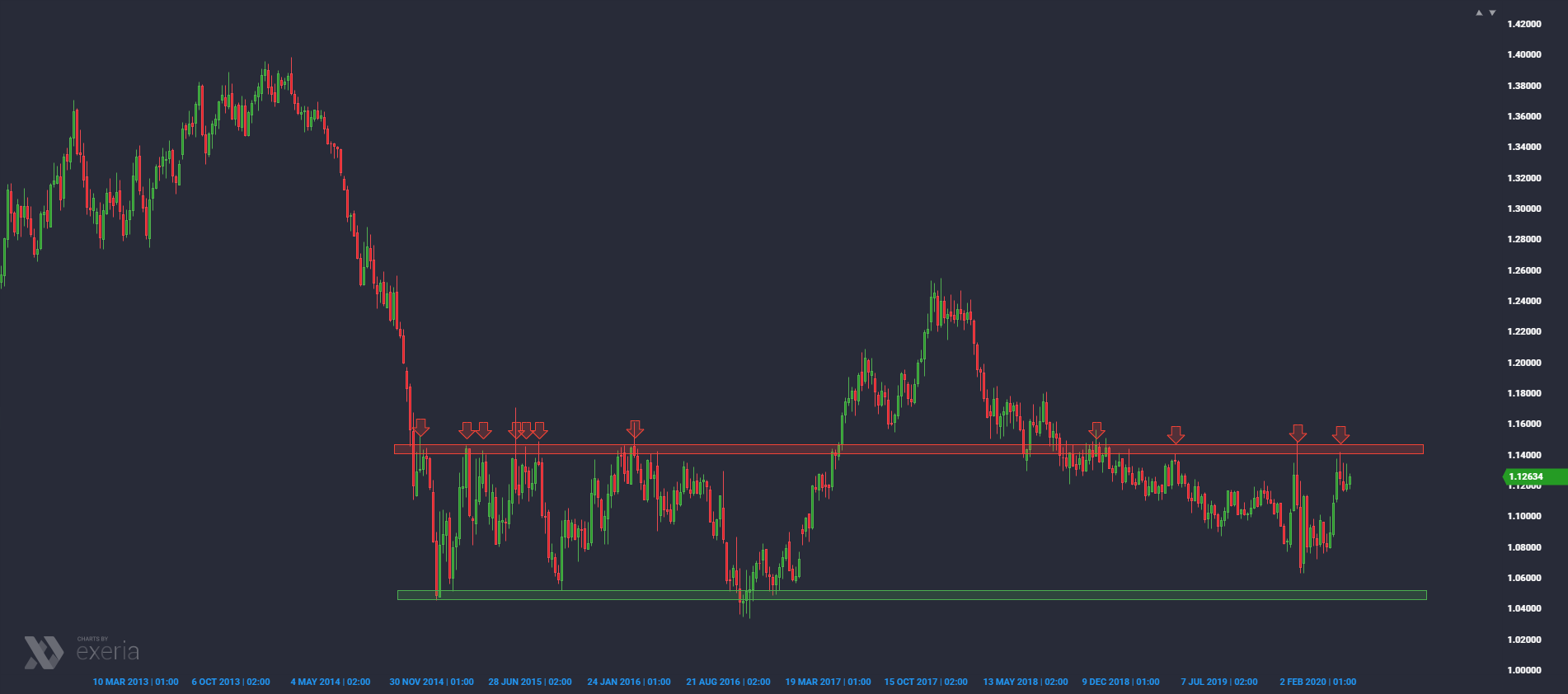

If we look at the long-term EUR / USD chart, it turns out that the recent upward move has not stopped in a random place. In the past, the area around 1.14-1.1450 has repeatedly held back the role of buyers. I marked the place of price reaction with red arrows.

If we look at the market in recent weeks, the shapes of candles in this interval clearly indicate that the sellers reactivated as they approached 1.14. The last few candles have clear upper shadows. The combination of a significant level and market response in this place is usually a good set to try to take short positions, hoping that the last shadows will be maintained.

What do Commercials think about the dollar?

In the Commitment of Traders report, we will see that Commercials, a group that is usually the most accurate positioner on the futures market in the long term, has been reducing its net short position in the dollar since the fourth quarter of last year. This tendency is also visible recently, when the involvement of this group of market participants began to even change into net long. This is a very positive signal about their perception of USD, and at the same time a warning against another wave of risk aversion, similar to that caused by Covid. At such moments, money flows just to the dollar and apparently Commercials position themselves for such a scenario.

Where can the market ultimately go?

The 1.05 area, which in the past also generated positive market reactions, is a strong support. Therefore, if we would like to lead the position with a wide swing, by securing it above the abovementioned resistance zone, we can count on achieving a risk / reward ratio of around 1: 3. The technical situation along with the conclusions of the Commitment of Traders report, in turn, presses the chances of a successful scenario of the US dollar strengthening in the following months, when the market may be afraid of even the turmoil that may occur as the presidential election in the United States approaches.