USA vs China

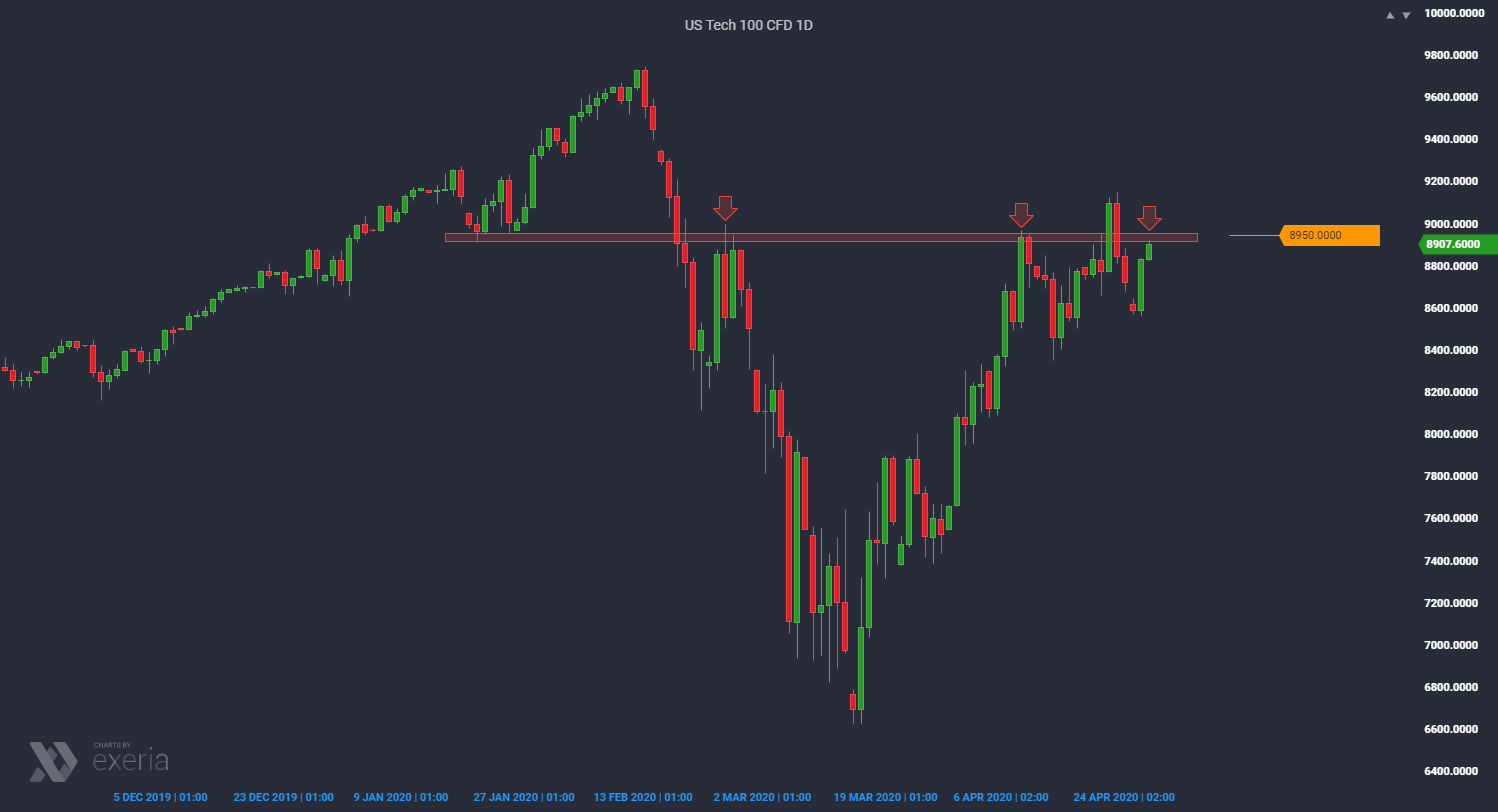

The consensus that blew out the pandemic The initial trade consensus between the United States and China reached in mid-January (disturbed by the effect of the global COVID-19 pandemic) was put to a very serious test these days. In our opinion, the situation is becoming so tense that a possible return to the starting point