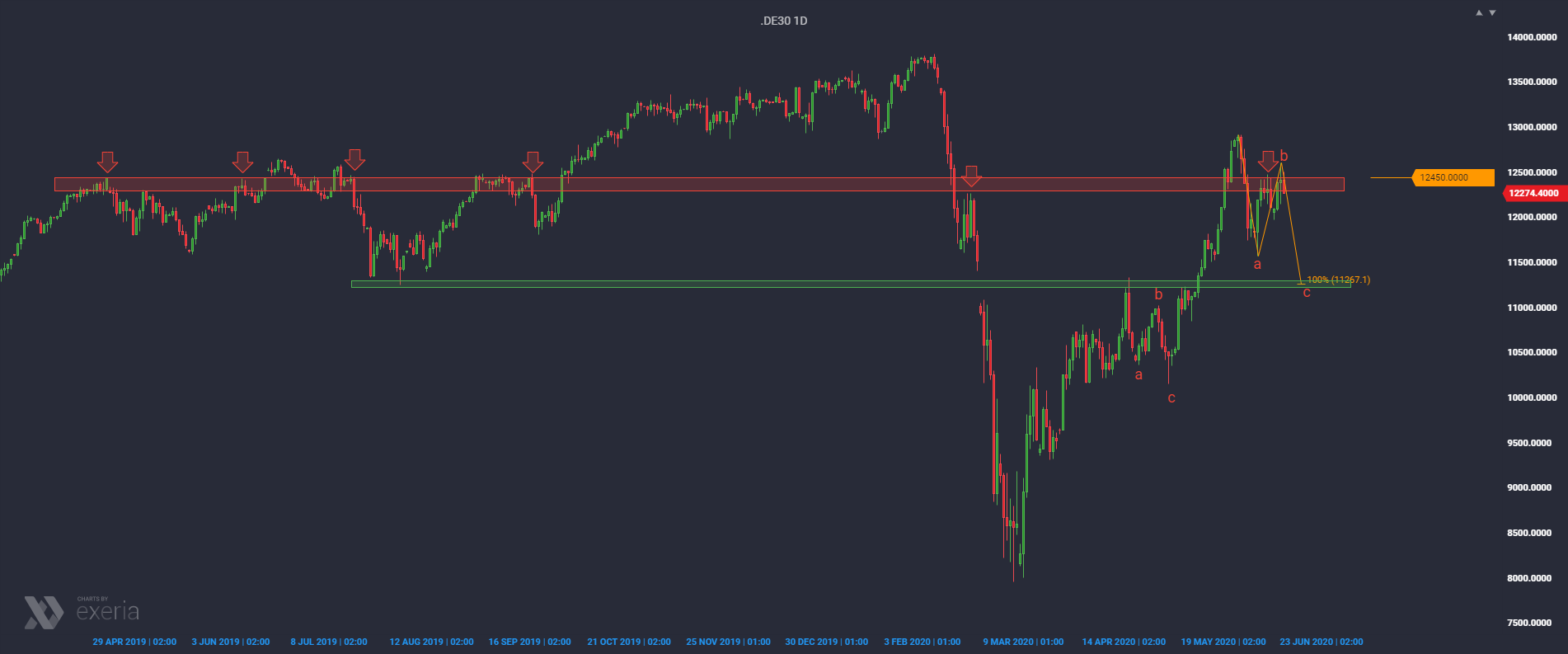

Since the beginning of this week, the bulls have been trying to get out of the weekly consolidation, built under resistance from the daily chart under 12450 points. I marked the previous places of reaction of the sellers with red arrows.

The bulls were closest to success yesterday, but instead of continuing the upward movement, doubts quickly arose, followed by today’s withdrawal. Such behavior within quite significant resistance is increasingly qualifying for interpretation as a bull trap. Whoever tried to play a breakout now has a problem, and as everyone knows, unused chances in the markets like revenge.

What can the consequences be?

If you look at the daily chart, defending resistance in the area of 12,450 points would mean that you should reckon with the turn towards the south. Assuming the construction of even a zig-zag correction with wave equality, the C wave end would fall in the area slightly below 11300 points, where you will also find support resulting from the area of recent, earlier peaks, but also last year’s August lows.