If you look at the major stock indices, the DAX has been catching the eye of technically recently.

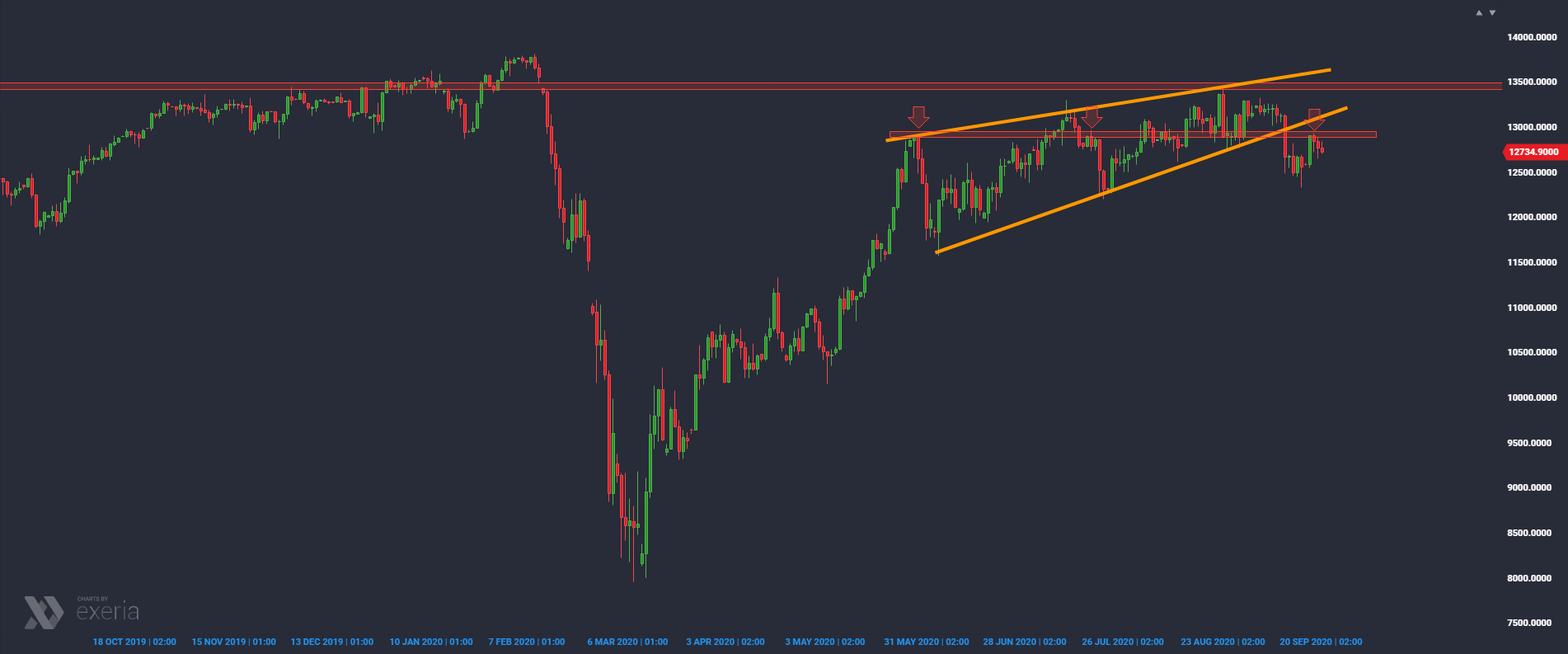

From the perspective of the weekly chart, we can see the ending wedge breakout. Its credibility was also enhanced by its precise placement below the horizontal resistance level. As you can see, the minimum range of the decline resulting from the wedge (the basis of the formation at around 11,500 points) has not been achieved yet, so it can be assumed that the market is still on the way to materializing this scenario.

The market is currently in a technically interesting place, as can be seen on the daily chart. The last bounce can in this case be interpreted as a corrective movement after breaking out of the wedge. It also stopped in the area of local, horizontal resistance. So this is a good place for the bears to try to expand the next downward wave, in line with the realization of the range from the wedge.